Medicare Open Enrollment is October 15, 2024, through December 7, 2024!

Are you turning 65 soon, preparing for your annual enrollment, or helping a loved one figure out Medicare? It can feel overwhelming at first – lots of parts, plans, and dates to think about. Let’s break it down together, step by step, so you can understand the basics and make the best choices for your health.

What is Medicare?

Medicare is a government health insurance program mainly for people 65 years of age and older. It helps cover things like doctor visits, hospital stays, and prescription drugs.

The Parts of Medicare

Medicare has different “parts,” and each one does something a little different.

- Part A is your hospital insurance, managed by the federal government. It covers things like hospital stays, nursing care, and some home health services. Good news: most people don’t have to pay monthly premiums for this one because they paid Medicare taxes while working. Part A will not cover your physician’s services during a hospital stay – that’s covered by Part B.

- Part B is medical insurance, managed by the federal government, that covers doctor visits, outpatient care, medical equipment, and preventive services like vaccines and screenings. You pay a monthly premium for Part B. Please be aware, only some vaccines are covered under Part B. Check your plan to see if the vaccines you need are covered.

- Part C is known as Medicare Advantage. It’s an alternative plan for your hospital, medical and drug coverage from a private insurance company.

- Part D helps with prescription drug costs. This is another option you buy from private companies. Each plan is a little different, so it’s worth comparing prices and coverage.

Prescription drug costs are not covered under Traditional Medicare.

If you sign up for Parts A and B, you also have the option of adding Medicare Supplement Insurance, also known as Medigap. This insurance provides additional coverage and can help lower out-of-pocket costs like deductibles, coinsurance, and copayments. However, many supplemental plans now offer lower monthly premiums but leave patients with higher out-of-pocket expenses when care is needed. It’s important to weigh your options carefully.

If you sign up for Parts A and B and Medigap, you will need to purchase a prescription plan separately.

Keep reading to see what Medicare coverage NMC Health accepts.

When Should You Sign Up?

Timing matters! Medicare Open Enrollment begins October 15, 2024, and goes through December 7, 2024.

If you’re new to Medicare, the Initial Enrollment Period begins three months before you get Medicare and ends three months after you get Medicare.

If you miss these windows, there’s a General Enrollment Period from January to March each year, but you may face penalties for signing up late.

Things to Think About Before Enrolling in a Medicare Advantage Plan

All the Medicare options can be confusing. Take the extra time to make the right choice. Ask yourself these questions before choosing a Medicare Advantage plan:

- Is my provider in-network? Location matters. Your local providers may not accept your Medicare Advantage plan.

- Can I get care close to home?

- Are my prescriptions and treatments covered?

- Do I have any budget concerns? Denials and inconvenience may offset what savings you gain.

- Will I be traveling? If you plan to travel out of state or out of country, your chosen advantage plan may not be accepted in that area.

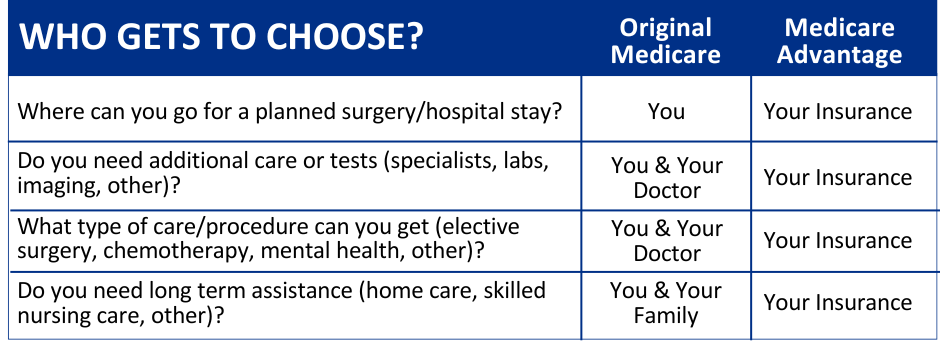

Your Choice Today Will Determine the Type of Care You Receive Tomorrow

Make Sure You're Covered at NMC Health

NMC Health accepts Medicare and most supplemental plans (see list below or download our informational PDF), as well as a variety of Advantage Plans.

- Check the list of accepted plans on our website

- Give us a call at 316.804.6255

Our patient financial experts are happy to let you know if the plan you’re choosing is accepted at NMC Health. We CANNOT advise you on enrollment or which plan to choose, but we may confirm whether your plan is accepted at NMC Health.

- Traditional Medicare

- Accepted at all NMC Health locations

- Supplemental Insurance

- Accepted at all NMC Health locations

- Exception: Blue Cross Blue Shield Plan 65 Select supplemental insurance is accepted for outpatient and emergency care only. If you receive care at NMC Health’s Emergency Department and are admitted directly to our hospital, your inpatient stay will be covered under Blue Cross Blue Shield Plan 65 Select. Planned inpatient care is NOT covered at NMC Health under Blue Cross Blue Shield Plan 65 Select.

- Medicare Advantage Plans

- We Contract With:

- Aetna Medicare

- Blue Advantage Medicare

- Humana Medicare Health Plans

- Kansas Health Advantage

- Kansas Superior Select

- Allwell from Sunflower Health Plan

- Wellcare (or Wellcare Plans) by Allwell

- We Do NOT Contract With:

- AARP Medicare Advantage Plans

- United Healthcare Medicare Advantage Plans

- United Healthcare Dual Complete Plans

- We Contract With:

HMO plans through an insurance on the NOT Accepted list are only accepted through the Emergency Department. However, you could be transferred from NMC Health to another facility, if further services are needed.

If you have a PPO plan through an insurance listed on the NOT Accepted list, you can have services here but you may have a higher out of pocket cost.

Protect Your Health

Medicare is an important step in protecting your health as you age. Take your time, ask questions, and get the coverage that’s right for you!